Payment for construction works is usually paid in instalments, however on very small projects alternative payment methods such as payment upfront or payment on completion may be utilised. The payment on completion option relies on the parties involved sharing a high level of trust. Conversely, the payment upfront method is risky for the Client as works could be delayed or not completed, therefore construction payments are usually paid in instalments.

Statutory protection for payment in construction

Part Two of the Housing Grants, Construction and Regeneration Act 1996 (HGCRA) supports the timely and regular payments in construction projects. All construction contracts entered into before October 2011 must comply with the Act and, after October 2011, they must also comply in line with the amendments made in Part 8 of the Local Democracy, Economic Development and Construction Act 2009 (LDEDCA). The amendments were made with the aim to make payments fairer and provide clarity and certainty.

This Act provides details of payment provisions – should a contract not include or is missing information on necessary payment provisions, then the rules of The Scheme for Construction Contracts (England and Wales) Regulations 1998 (Amendment) (England) 2011 (The Scheme) will apply. The sections and clauses referred to in this blog consider the requirements for contracts entered into after October 2011.

Payment timelines

If a project is due to take longer than 45 days then under Section 109 (1) of the (HGCRA), the contractor is entitled to instalments, stage payments or other periodic payments, as it would be unfair to expect the contractor to fund all the works upfront and not get paid until the end. Section 109 (2) also states that the payment amounts, and intervals can be agreed between those involved (HGCRA, 1996).

Section 110 (1) of the HGCRA provides information on the dates for payment and states that the contract should provide ‘an adequate mechanism for determining what payments become due under the contract’ (1996). This information is included in the JCT SBC 2016 under clauses 4.14 and 4.15. General provisions regarding payment, certificates and notices are included in the SBC 2016 in clauses 4.7 to 4.13.

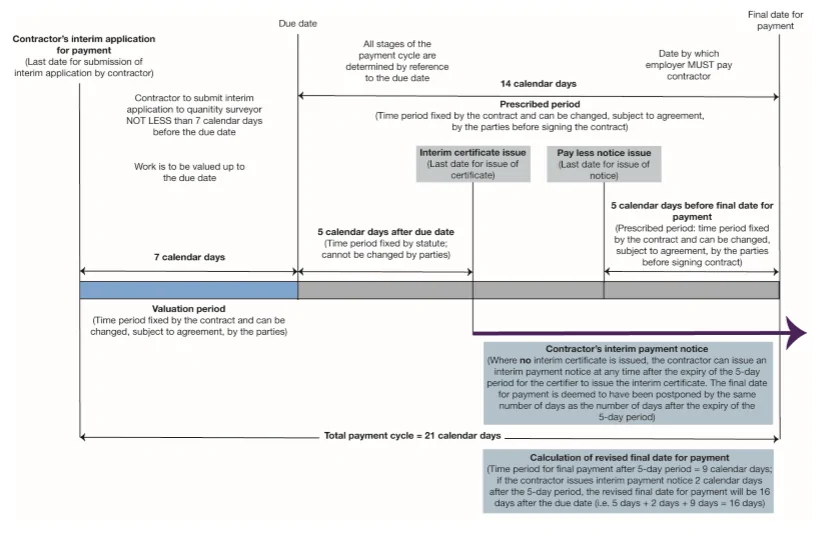

Figure 1: JCT SBC Payment Timeline

Source: RICS, 2015

Housing Grants, Construction and Regeneration Act 1996 (HGCRA)

For a contract to be valid under the HGCRA, the following items must be addressed and included: what amount is due and when, the final date for payment (interim and final), the payment notice outlining the amount due and how it is determined, the default notice and the pay less notice.

They must also adhere to a strict time frame, which if not outlined in the contract, will follow the timings in the Scheme. The time frames will vary depending on the specified contract and can be amended for individual projects. The total payment cycle which applies to all forms of JCT SBC totals 21 calendar days and the specific timings can be seen in Figure 1. The statutory dates between the due date and final date for payment in ‘The Scheme’ are 17 days, whereas JCT contracts standard provisions are 14 days.

Under the HGCRA, a payment notice must be provided for each payment in the contract that contains the notified sum which can be issued by a ‘specified person’ for example the Client, Architect or Contract Administrator and must be issued within 5 days of the due date. A pay less notice can be issued if the payer feels less than the notified sum should be paid or if the contractor requires less than that outlined on their interim application for payment. However, the timing is critical, and it will not be valid if not served on time. The amended HGCRA states that the pay less notice must include the calculations to show the reductions and reasoning.

The contractor also has the right to suspend works under the Section 112 of the HGCRA if they are ‘not paid in full by the final date for payment and no effective notice to withhold payment has been given’. Clause 4.13 of JCT SBC states that the employer has a further 7 days to pay the contractor after they have given notice of their suspension and works can be suspended until full payment is received. It should also be noted that ‘pay when paid’ clauses were removed from contracts as per Section 113 of the HGCRA and Paragraph 11 of the Scheme (2011).

It is important that all parties to a contract are aware of the provisions and the specified dates. If the contract does not state specific dates this will not exempt a party to paying as the dates strictly outlined in the Scheme in line with the relevant acts will be enforced.

The team at Bradley-Mason LLP has a wealth of commercial surveying, project management and contract administration expertise gained across a wide range of sectors. For more information about working with Bradley Mason, please contact us to discuss your requirements.

DISCLAIMER: This article is for general information only and not intended as advice. Each project has its own set of unique circumstances, all potential issues should be investigated by a surveyor on a case by case basis before making any decision.