What are Brick Bonds?

Brick bonds are how bricks are arranged within a wall and can provide a decorative finish to what can be one of the main components of a building. Across the many types of bonds that can be used to build a wall, the test of time has rendered a few favourites in terms of their integrity and decorative appeal. The Stretcher Bond offers simplicity, while the Flemish Bond showcases intricate alternating patterns. The English Bond provides superior strength as the stack bond relies on its ease of laying and reinforced internals to give it its uses in buildings.

Stretchers are the brick’s longest edge whereas the shorter edges are referred to as headers. Below we will discuss some common bonds and their key characteristics:

Types of Brick Bonds

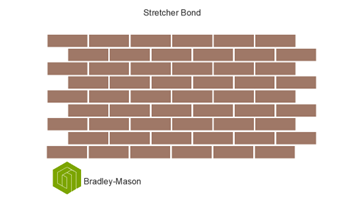

Stretcher Bond:

This is where only stretchers are laid, offset by half a brick in each course. This bond is the most common in the UK and is often found on either side of a partition wall, bound together by wall ties. Stretcher Bonds appear uniform and are easy and fast to lay. Because they are only one brick thick, they often take the form as a facing layer to buildings, this helps reduce costs as cheaper and less aesthetic materials can be used on inner layers. The downside to this bond is its lack of strength. With it only being one brick thick it struggles to maintain its stability as the wall gets higher, this is why wall ties are used.

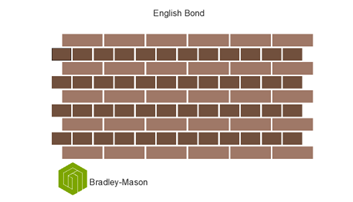

English Bond:

The English Bond is one of the oldest types of bonding and is still used for its noticeable appearance to this day, however now regularly the headers are only half thickness. This bond consists of alternating courses of headers and stretchers giving it superior strength and load bearing capabilities. There are often decorative additions to this bond, for example a different colour can be used to highlight a diamond shape within the brickwork.

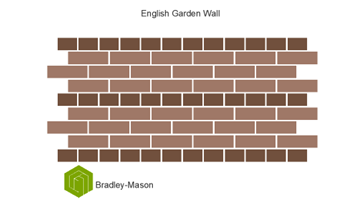

English Garden Wall:

This bond consists of one course of headers for every three courses of stretchers, again giving it a distinct and unique pattern. The English Garden Wall allows the use of less facing bricks and in turn means there is less need for every brick to be perfect.

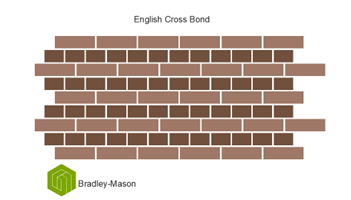

English Cross Bond:

Largely the same as the English Bond, however every other course is offset by half a brick’s length. This provides further strength to the English Bond by moving the lines of pointing further away from each other.

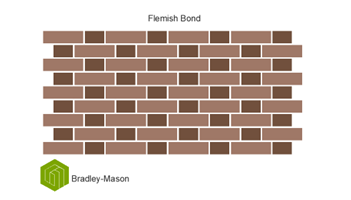

Flemish Bond:

The Flemish Bond moves away from separate rows of headers and stretchers and combines them into one course. Each consists of alternating headers and stretchers with the course below offset so the header of the below course meets the centre of the stretcher on the above course. The Flemish Bond first appeared in the UK in the 17th century and is now synonymous with the Georgian era.

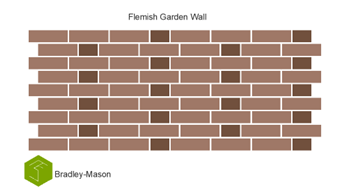

Flemish Garden Wall:

This bond is closely related to the Flemish Bond, with three stretchers in between each header instead of just one. Like the English Garden Wall, the Flemish Garden Wall Bond results in fewer facing bricks while maintaining the intricate and appealing bond.

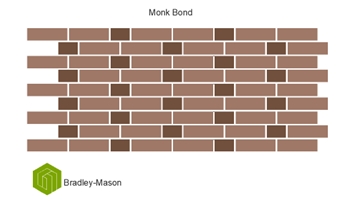

Monk Bond:

Similar to the Flemish Garden Wall there are only two stretchers in between each header with the Monk Bond. The headers are central to the gap in between each pair of stretchers making for another decorative and strong bond with no crossing of the pointing in between each brick.

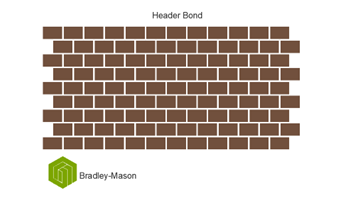

Header Bond:

Back to a simple bond, the Header Bond consists of layers of headers each offset by half a brick. This provides greater strength and stability than a Stretcher Bond due to its double thickness however this does use the most facing bricks owing to how short each face is.

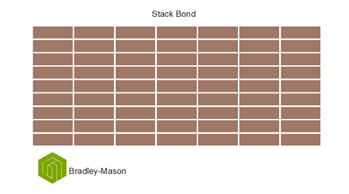

Stack Bond:

Finally, the simplest, but weakest bond is the Stack Bond. This is layers of stretchers all stacked in line. This offers simplicity and uniformity but is the weakest of all the bonds. To improve its load-bearing qualities this bond is often combined with metal wire in between each joint.

Conclusion

It is clear each bond has their own qualities and downfalls in terms or aesthetic appearance and strength. Historically each bond gives a nod to an era of buildings defining them and giving them character. As we progress further into modern methods of construction, the strength of each bond may become obsolete as we commonly only use them as facing layers.

DISCLAIMER: This article is for general information only and not intended as advice. Each project has its own set of unique circumstances, all potential issues should be investigated by a surveyor on a case by case basis before making any decision.